7 Best Ways on How to Pay for a New Roof

Wondering how to pay for a new roof? There are several options available to help you manage this expense. This article will cover insurance coverage, financing through roofing companies, personal loans, home equity loans, and even government programs. By the end, you’ll know the best way to fund your new roof.

Key Takeaways

- Understanding the cost factors for a new roof, such as material type, roof design complexity, and labor costs, is essential before exploring financing options.

- Homeowners insurance may cover part of the roof replacement costs, but it’s crucial to review coverage details, deductibles, and specific policy limitations.

- Various financing options are available for roof replacement, including personal loans, home equity loans, credit cards, and government programs, each with distinct pros and cons.

Assessing Roof Replacement Costs

Understanding the various factors that influence the cost of a new roof is essential before considering financing options. The total cost of a roofing project can vary significantly based on several key elements.

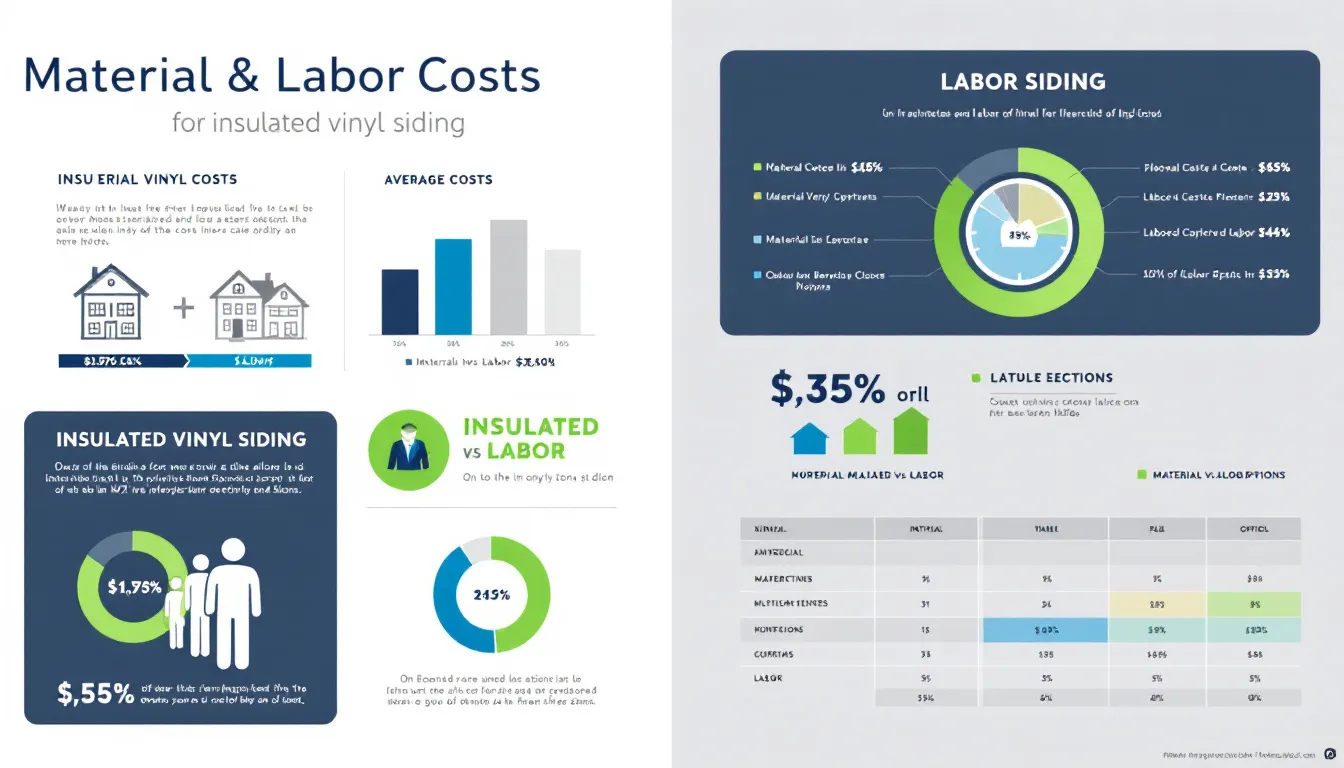

Firstly, the type of roofing material you select plays a significant role in the overall cost. For instance, asphalt shingles are generally more affordable than metal or slate roofing. Additionally, other components like underlayment, vents, and flashing add to the total expense.

Another factor to consider is the complexity of your roof design, including:

- The number of angles and facets

- The steepness of the roof pitch, which can drive up both labor and material costs

- Accessibility issues related to the roof, such as limited space for equipment and workers, leading to increased costs due to additional labor required.

Lastly, labor costs, which are influenced by the skill level and speed of the workers, are a major factor in roof replacement pricing. Operating expenses of a roofing company, including insurance and vehicle costs, as well as other costs, are also factored into the pricing of roofing projects. Comparing quotes from different roofing contractors can help you understand significant differences in costs and the rationale behind them.

Homeowners Insurance Policy

Many homeowners might not realize that most homeowners’ homeowners insurance policy could potentially cover only a portion of the cost of a new roof. However, there are several factors to consider when determining if this is an option for you.

Firstly, the type of coverage you have and the cause of the roof damage are crucial. For example, if a tree falls through your roof during a storm, claiming insurance coverage for such apparent damage is often easier. However, it’s important to start the claim process before any repair work begins. Your insurance company will send an insurance adjuster to assess the damage, and a roofing contractor can help identify storm damage and relay that information accurately.

Many homeowners mistakenly believe that their insurance will cover most of the replacement costs without considering deductibles and specific policy limitations. Contacting your insurance agent helps clarify coverage details and whether you qualify for an insurance claim for roof replacement. Factors like the insurance company, type of coverage, and cause of damage will influence the percentage of repair costs covered.

If your policy does limited warranties offer coverage for roof replacement, it can substantially protect your finances and save homeowners a significant amount when you pay for a new roof. Make sure your policy covers potential natural disasters and other unforeseen events regarding roofs, including replacement cost considerations.

Financing Through Roofing Companies

Many roofing companies offer convenient roof financing options to help homeowners manage the cost of roof replacement. These options can include in-house financing and partnerships with third-party financial institutions, providing a flexible financing option for those in need.

One attractive feature of financing through a roofing company is the availability of promotional rates, such as zero percent interest for a specified period. This can be an enticing option for homeowners looking to finance their roofing project without accruing interest initially. When comparing these financing options, it’s vital to consider the Annual Percentage Rate (APR), repayment terms, and any additional costs associated with the loan.

Roofing contractors can provide valuable guidance in selecting financing options that align with your budget. They can explain common payment plans available from their services and help you understand which option suits your financial advisor needs best. Roofers offer payment plans that require you to pay upfront and are often tailored to meet different financial requirements.

Choosing a reputable roofing company that offers financing can simplify the process and provide peace of mind. Always ensure that the contractor you choose is a local roofing company that is trustworthy and has a good track record with financing programs.

Personal Loans for Roof Replacement

Personal loans are another viable option for financing a new roof. These loans are typically unsecured, meaning they don’t require collateral like your home. Interest rates for personal loans can range from 6% to 36%, with higher credit scores leading to lower interest rates.

Examining the loan length and interest rate is crucial when considering a personal loan for roof replacement. Repayment periods usually span two to seven years, and fixed monthly payments can simplify budgeting for homeowners. However, borrowers with high debt-to-income ratios may face challenges securing personal loans.

Lenders assess qualifications based on credit score, income, and additional debts. Homeowners with good credit can expect lower interest rates and better approval process chances. It’s recommended to compare options across other banks before applying for a personal loan. Most lenders consider common funding sources, including banks and financial institutions like Bank of America and Wells Fargo, which also consider your credit rating.

Personal loans can provide the lump sum needed to cover roofing costs, making them a convenient option for homeowners who require financing to get extra money for more money.

Home Equity Loans and HELOCs

Home equity loans and Home Equity Lines of Credit (HELOCs) are popular options for financing home improvement projects and other home improvement projects, including roof replacement. A home equity loan is a loan secured by your home for a fixed amount of money, while a home equity line is a line of credit using your home as collateral.

One of the main benefits of home equity loans and HELOCs is their typically lower interest rates compared to unsecured loans. Home equity loans offer low monthly payments with fixed monthly installments, resembling mortgage payments. In contrast, HELOCs provide a flexible withdrawal option, allowing homeowners to access funds as needed.

However, considering the risks is crucial. Failure to make payments on home equity loans can result in severe consequences, including foreclosure. The collateral for these loans is the house itself, so it’s crucial to assess your financial circumstances and repayment ability.

To qualify for a HELOC, your home value must be at least 15 percent more than what you owe. Calculating your home equity involves subtracting the amount owed from the current home value and multiplying by 0.85. Deciding between a home equity loan and a HELOC depends on your financial situation and intended use of funds.

Credit Card

Using credit cards for roof financing can be a quick and straightforward solution, but it comes with its own set of pros and cons. One advantage is the potential to earn rewards like cashback or travel points when using certain credit cards for home improvements. Additionally, many roofing contractors accept credit cards, making it a viable option for immediate payment.

Key points about credit card interest rates and financing home improvements:

- High interest rates can escalate costs if the balance is not paid off quickly.

- Credit cards that offer introductory 0% APR can be beneficial for financing home improvements without accruing interest initially.

- Failing to repay the full balance within the promotional period can lead to steep interest charges.

- The average credit card interest rate can exceed 21%, which emphasizes the need for careful budgeting regarding credit card payments.

Using credit cards for roof replacement can negatively impact credit scores if payment is not managed effectively. Homeowners should:

- Assess their repayment ability before financing through this method.

- Choose credit cards with favorable APRs and reward options.

- Look into other bank financing options for better terms before putting roof payment on a credit card.

Government Programs and Grants

Government programs and grants can provide substantial assistance for homeowners requiring roof financing. The FHA Title 1 loan, for example, is available under the following conditions:

- Homeowners must own the home or have a long-term lease.

- They must have occupied the home for at least 90 days.

- Eligible applicants must have a debt-to-income ratio of less financing than 45 percent.

- The maximum loan amount without needing equity is $7,500.

One of the advantages of the FHA Title 1 loan is that:

- There is no prepayment penalty, making it accessible to a broader range of homeowners.

- The FHA insures private providers offering the Title 1 loan to enhance accessibility for borrowers.

- There is no minimum credit score requirement.

The Section 504 Home Repair program provides loans to very low-income homeowners for home repairs and grants to elderly homeowners for health and safety issues. To qualify for a grant under this program, applicants must be at least 62 years old. Applications for the Section 504 program are accepted year-round through local USDA Rural Development offices.

Both loans and grants can be combined for a total of up to $50,000 in financial assistance for home repairs. These government programs offer financing options that can make a significant difference for homeowners who require financial assistance for roof repairs and roof replacement.

Summary

Financing a new roof can seem overwhelming, but with the various options available, you can find a solution that fits your financial situation. From assessing the replacement costs to exploring homeowners insurance, roofing company financing, personal loans, home equity loans, credit cards, and government programs, each method offers unique benefits.

Choosing the right financing option is crucial to ensure you get the best value and protect your investment. Whether you opt for a personal loan, a home equity loan, or a government grant, make sure to thoroughly research and compare your options. With the right approach, you can have a new roof installed without compromising your financial stability.